Matt

Revealing System Structures

Matt:

What is theory of change:

A method showing the impact resulting from an investment where investors can discuss actions that will bring change regarding societal issues, helping individuals or building organizations. It is a kind of route map that leads to results by transforming funding and assistance.

Diverse objectives and investors:

Some investors have the objectives to support clients in need and others like more to address societal issues such as encouraging education, strengthening health services or lowering poverty. Other investors are more interested in the development of companies by improving long-term sustainability or charities. In any case, for each of the different goals mentioned above, there is a need for a different approach to the theory of change and the goal of the investor must be reflected in the plan.

Placing development in organizations first:

An investor is considering change as the way non-governmental organizations or foundations are expanding in order to have a significant influence on groups, including the decision to assist particular kinds of businesses in providing services, that differ from financial support, like coaching, instruction or strategic guidance, which is also known as “the investor plus” activities 'term. This strategy, which has a bigger lasting influence, also increases the organizations’ effectiveness.

Inorporate the two achievements and organisation:

The investors who share a specific objective and invest for the improvement of organizations must look in both ways into their theory of change: one section addresses the results they hope to obtain while the other concentrates on how to improve inside jobs of the businesses. Since it guarantees that the organizations are sufficiently stable to produce lasting impacts, both of these approaches are effective.

A local development challenge:

One of the main problems regarding global development is that most of the investors and particularly governments are granting funds on specific projects like construction of campuses or launching of health programs, but do not fund the capacity of the organizations to help them manage social inclusion efforts such as youth support or migrant integration. If we take as an example the community organization called “Trajekt” located in Maastricht, if funders would offer more training or strategic development funds rather than just projects, it would help organizations to be more sustainable and more effective and help resolving the housing and inclusion challenges rather than the infrastructure. Due to the lack of appropriate assistance, it is becoming more and more difficult for small businesses to become more efficient or to expand.

Another example from the Limburger Region:

A lot of traditional firms are now prioritizing sustainable growth. One good example in the Limburger region is ‘Gulpener Bierbrouwerij’ that has developed from being a family-owned beer company to a regional sustainability leader using local and organic ingredients. The company is also an energy-neutral brewery using solar panels and advanced energy technology as a STEAMpump that is a solution to move away from natural gas. This shows how companies can become innovators rather than only focusing on profit.

Page 29-

The logical model: the basis for assessment:

The essential components based on the logical model are inputs, activities, outputs, outcomes and impacts. They are helping to evaluate how a project works. Techniques of assessment ensure that the projects are assessed in a structured and accountable way.

Carol Weiss on sophisticated programs difficulties:

In the book called "New approaches to evaluating comprehensive community initiatives" written in 1999, the author, Carol Weiss, explains how complicated it is to evaluate complex programs. This is mainly due to the lack of clear understanding or ability to explain how change is supposed to occur. It is also due to the fact that the ones responsible for the planning and carrying out social projects mainly concentrate on the future targets rather than considering the initial planning. Strategy, building partnerships as well as the implementation of activities, increasing awareness, improving coordination between services are all part of the learning process which constitute all the phases of advancement.

The importance of beginning and mid-term steps:

According to Carol Weiss, when the 'mini-steps' are not well defined, it is difficult to monitor correctly projects. All these short- and medium-term adjustments are crucial to produce larger outcome because without a clear view, the project will not reach its long-time objective. The absence of information leads to misunderstandings and could make the project less successful overall.

How it transcribes governmental structures:

The Theory of Change (ToC) is a method for strategic thinking describing how investments or activities result in benefits and particularly social ones. It functions like a route map for governments, connecting investments and initiatives to easily measured effects on society. If we take for instance the public health sector, a ToC aids in outlining the actions required to improve the quality of life, such as financing, education and awareness-raising initiatives. For a governmental structure to be successful, the same strategy needs to be applied. Government agencies need to have priorities the same way investors do and need therefore customised ToCs in sectors such as economic growth, education and health. This illustrates how crucial it is for government agencies to have a strategic connection so that everyone has a clear goal and plan.

The importance of growth in organizations is one of main ideas in the ToC model. To have a durable effect, funding must be allocated to both the organizations monitoring the projects and the initiatives themselves, such as the construction of schools. Governmental initiatives can become unsustainable if procedures such as management and staff training are not strengthened.

Governments are also covered by the idea of "Investor Plus," in which funders provide assistance in management efficiency such as educating local government officials and upgrading services to the public in exchange of financial support. A government that functions in the role of Investor Plus has more chance to be successful.

It is important for governments to prioritize both the creation of capacity and production of results as investors would do. Improving job centers and increasing training courses are helping to reduce the number of unemployed people and when the objectives and the capability are in line, there is a guarantee for a program to be effective and sustainable.

The focus on the improvement of institutions is more important than initiatives such as donations which only provides short term gains. By taking the example of ‘Gulpener Bierbrouwerij’, we see how business may move from making money to making a difference and this is exactly the kind of example, governments can follow by carefully planning for the future, encouraging transparency and responsibility. Public organizations can be strengthened by frequent evaluations of results.

The logical model is a strategy and evaluation technique that aids governments in monitoring development, measuring usefulness and maintaining accountability. If governments have not the right tools to operate, they may face some challenges to grow. As Carol Weiss underlined the importance of precise actions, it becomes challenging to monitor achievements and measure policies when governments are more focused on targets and ignore the short and long-term strategies.

ToC models usually disregard the consequences of failure but adaptibility is critical. It is important to have feedback processes, particularly in the early stages, as it only benefit the strategy to be followed, the responsibility and the visibilty improvement.

sources:

https://www2.hu-berlin.de/transcience/Vol9_No1_20_51.pdf (Pages 24/29)

Digvijay:

Page 37:

Impact Management Project (IMP)

The Impact Management Project shows a big advancement in impact measurement by focusing on detailed impact management than just measurement. More than 1,000 organizations and benefactors have participated in this combined effort since its start in 2016.

Key features:

Understands that outcomes can be both good and bad.

Focuses on determining what is important and to who it is important.

focuses on the frequent differences between initiatives that are done and community needs.

Highlights the community's perspectives, which are often overlooked in other approaches.

Five core dimensions:

What the outcomes relate to and the importance to the people who are affect by it

How important is an effect in a time period? How many people are affected? How long does it last, and how quickly does it happen?

Who are the impacted groups, and how underserved are they?

Comparing the effect to what would have happened in any case is known as contribution.

Risk: which factors are important and how likely is it that the outcome is different then expected

Critical Reflections on Impact Measurement

Most reports show outputs and results, but they don't fully show the effect.

Reports often put the number of persons contacted, but how their lives were impacted is not record.

Impact measurement is expensive and should be assessed independently, but the enterprises and NGO’s don't have the resources.

Funders and grantees should invest more money in accurate measuring to learn from results and to make better projects.

The logic model is the best available option for impact measurements should be promoted more with a combined effort by the international community This will make impact measurement more standardized.

The industry needs uniformity just like financial reporting standards do. The non-financial performance measurement needs to be standardized and uniformed like financial performance measurement is through the International Financial Reporting Standards Board.

Because it has parts from the Theory of Change, Logic Model, RCTM, SROI, and IRIS, the IMP is looked at to be more detailed and thorough than other approaches but it still lacks a clear feedback mechanisms. It is believed that a second IMP phase will show the evolution of the method.

Page 39-40:

Investment Return Continuum or Investment Models

Based on how well financial and social rewards are balanced, the investment landscape can be divided into four primary types:

Conventional Business Investments: These investments prioritize financial gains over any social or environmental effects.

Sustainable/Responsible Investment: Give priority to monetary gains while taking into consideration the influence on society. This is broken down into:

A. Certain societal rewards for investments

B. Investments that avoid harmful effects but do not guarantee to have a beneficial social impact

Social Impact Investments: Give social benefits priority while expecting certain financial gains.

Traditional Philanthropy: This type of philanthropy does not expect financial gains and instead focuses only on societal benefits, such as:

A. Plain donations

B. Venture philanthropy (which combines observation and assessment)

Important Developments and Trends:

Investments have been moving away from conventional profit-focused strategies and toward more responsible ones since the 2008 financial crisis and growing environmental awareness.

Schumacher's 1973 book "Small is Beautiful" criticized materialism's uncontrolled desire for money in a finite world, pointing out that companies that prioritize maximizing short-term profit usually fail to balance the triple bottom line (profit, people, and the environment).

The feasibility of socially and ecologically conscious banking is shown by alternative banking models like Triodos Bank and Germany's GLS Bank, which was established in 1974 and saw substantial expansion during the 2008 financial crisis.

Organizations like the Asian Venture Philanthropy Network (AVPN) and the European Venture Philanthropy exchange their best practices through networking and connecting to get towards a common vision. They do this to promote responsible investing.

The European Venture Philanthropy Association (EVPA, established in 2004) has developed to encourage responsible investment. As of 2018, AVPN had 370 members in 28 countries, while EVPA had 210 members in 25+ countries.

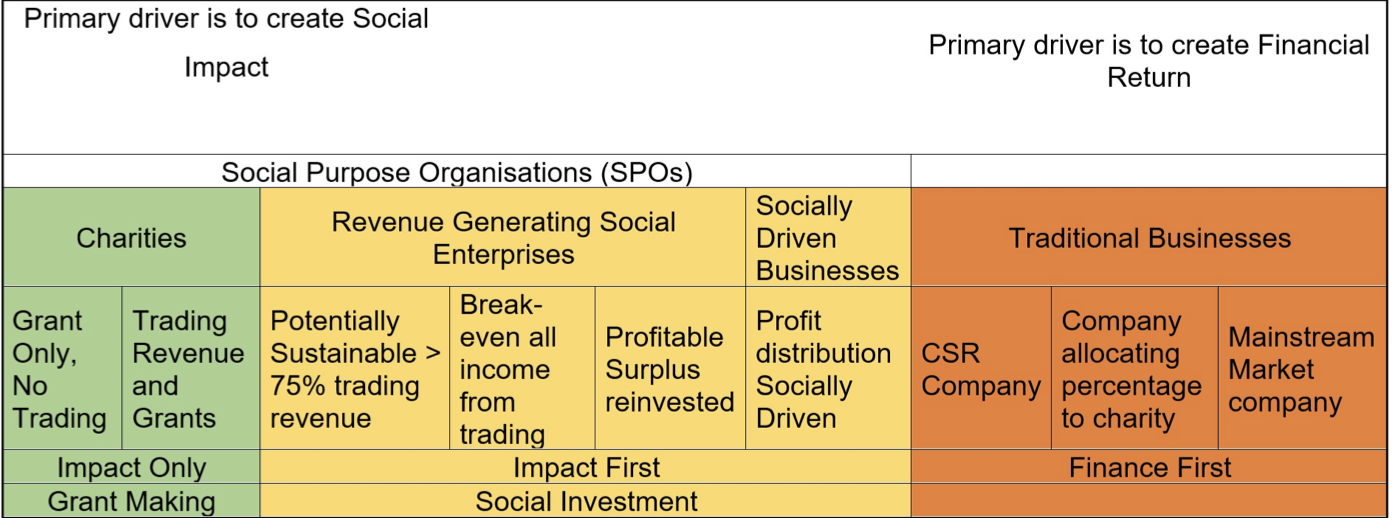

“The European Venture Philanthropy Association (EVPA) has evolved the Investment continuum even further and it looks like this.”

Page 41:

Impact Investment

Three core ideas set impact investment apart from traditional investment techniques and make it a unique method of distributing wealth.

The first is the expectation of financial return, which might be competitive or even above market performance, or it could be below-market rates. Second, these investments go beyond financial gain and are done to address environmental or social issues. Third, impact investors pledge to use established criteria to measure and report results, guaranteeing accountability.

The idea of ethical investment is not a new development. Famous examples of its centuries-old roots include the Quakers of the 1600s, who refused to finance slavery because of their religious convictions.

In the 20th century, many innovative institutions made the contemporary movement structure:

The Pioneer Fund was the first investment fund to officially avoid making "unethical investments" in 1928.

Issue screening and below-market investing were first adopted by the Calvert Social Investment Fund in 1982.

Despite being formally established in 1983 Grameen Bank started providing microfinance in 1976.

In the 1970s, banks such as GLS in Germany and Triodos in the Netherlands developed thriving socially conscious banking practices.

Initiatives in the social area have tradionaly used charity funding. These gifts were given with no expectation of financial return just simply proof of beneficial effects. This strategy has worked well for busineses in their early stages that need flexibility, risky ideas, and difficult business models. But since the late 1990s, there has been an increase in awareness that grant-only support isnt always equal in ecosystems with long-lasting effects. This change in viewpojnt resulted from a number of things.

The following made the limitation of grants clear:

Examples of resource misuse and unsustainable results.

Fears that "free money" occasionally limits innovation and professional growth.

Economic downturns decreased the amount of philanthropy funds available

International monitoring of foreign aid is growing

Growing protectionism forces businesses to create a balance between profit, people, and the environment.

Famous impact investment expert David Carrington makes the case for a balanced viewpoint. According to him, grants are still necessary and appropriate in some circumstances at every stage of an organization's existence. Though, because grant funds are little and valuable, they should be saved for situations in where other financing sources would be less successful.

The growing agreement suggests a complementary strategy. As charitable funding declines, organizations that rely entirely on grants are recommended to find other sources of income. Generating revenue often improves openness and accountability.

Strategic grant financing can cause systemic changes instead of continuous operations, even for models that give full income. More and more progressive grantmakers and investors are supporting systemic transformation, knowledge management, organizational capacity building, and specialized initiatives.

An important part of this ecosystem is impact measurement, which takes place at three levels of investment:

pre-investment analysis to gain the determine effect and guide choices.

Continuous assessment throughout implementation to allow for course modifications.

evaluation after the investment to determine the results and impact of the project.

The impact investment market is still growing at a fast rate. According to the worldwide Impact Investing Network, the worldwide market was valued at $228 billion in 2018. Since 2000, more than 220 impact firms in India have received $1.6 billion in funding.

When it comes to creating the infrastructure for impact investments, the UK has become a worldwide leader. Several significant changes have happeneed throughout their journey:

creation of the Social Impact Investment Task Force (2000)

The first Social Impact Bond was created in 2010

The first wholesale impact investment firm, Big Society Capital, was established in 2012

David Cameron led the creation of the G8 Social Impact Investment Taskforce (2013)

Tax breaks for social initiatives were introduced for investors in 2014

extension to Australia, India, Brazil, Israel, Mexico, and Portugal in addition to the G7 (2015)

The advancements made since 2010 show that there is a growing commitment all over the word to changing investing methods to be more socially and environmentally responsible.

(Page’s: 37, 39-40, 41)

SOURCE’S:

https://www2.hu-berlin.de/transcience/Vol9_No1_20_51.pdf

https://sciencepolicy.colorado.edu/students/envs_5110/small_is_beautiful.pdf