Philip, Tommy

Understanding Mental Models

Mental models we will be investigating (Tommy):

Mental models appear everywhere in the world of investing. They are crucial to dictate in order to investigate problems and gaps within investing processes, which is the primary behavior we are tracking.

Psychological biases that affect investment decision-making are one area in which mental models can be observed. Mental models are subconsciously present, influencing every single investment decision. They are imperative to look into as they pave the foundation for why investment decisions are made, what specifically these decisions and investments rely on, and what triggers them.

Some of the major psychological biases that affect investment decision-making include: - (Philip)

Loss aversion:

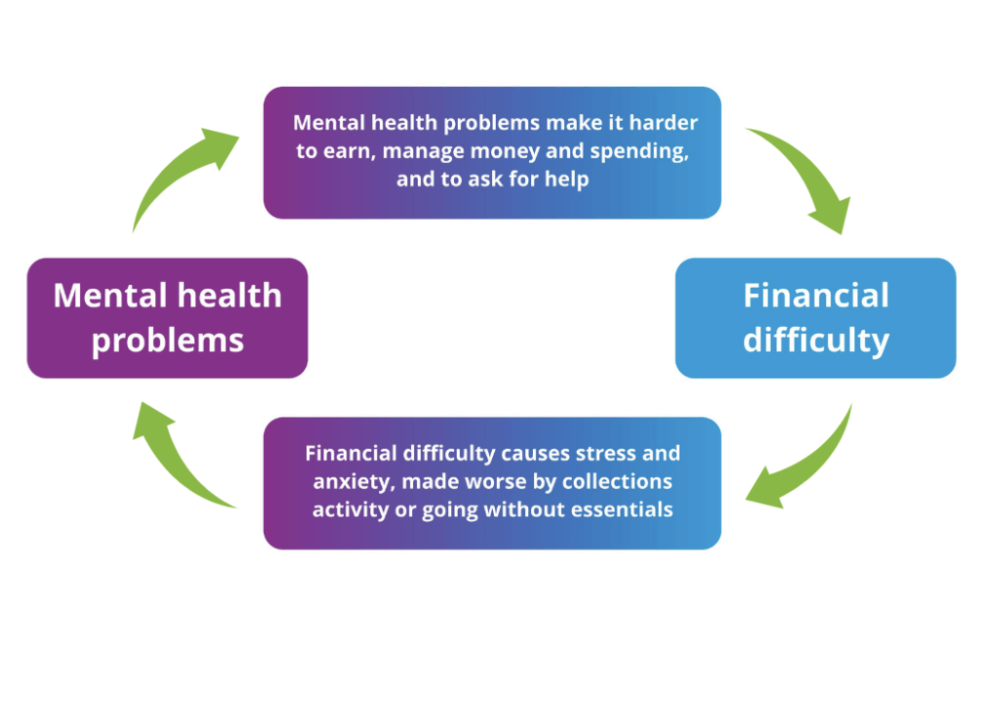

(1) Loss aversion refers to the human tendency to prefer avoiding losses over acquiring equal or more gains. For investors, this means that the fear of potentially “losing” value can dominate the decision-making, even if an investment offers high social or long-term financial returns. In the context of emerging markets, the fear of wanting to invest in projects with uncertain outcomes, despite their potential for high social impact, can limit capital flows. This is also common within the impact investing market, as it is something new and upcoming, meaning people are uncertain if they invest, that they will be making big money returns.

Confirmation bias:

(2)Confirmation bias is the tendency to favor information that confirms pre-existing beliefs, while disregarding data that challenges them or that proves something will not work. This bias can be particularly problematic in impact investing. Investors might seek out success stories that reinforce their views about certain sectors (or avoid ones that suggest a need to change), thereby ignoring warnings about unsustainable uses or emerging opportunities in social impact investments.

financial inertia:

(4)Investing inertia, also known as financial inertia, is similar to loss aversion, in simple terms, being a condition in which you are comfortable doing nothing. This can be due to the fear of making the wrong decisions and messing up, which could lead to consequences. This can also be because you are faced with multiple financial decisions, maybe being overwhelmed, struggling to pick a single one, therefore resulting in postponing the tasks. More than 48% of people within the Netherlands have financial issues, particularly confusion regarding investing and financing. This directly relates to financial inertia, as they have the required money (in most cases), but don't know what to do with the money they have. People have options to invest but avoid doing it due to the fear of making a mistake, or simple indecisiveness, stopping them from doing it. Additionally, this relates to social impact investing, as people have the fear of making wrong investments, therefore not investing, as a result of financial inertia.

(1)Source 1:

(2)Source 2:

(3)Source 3:

(4)Source 4:

Chicago Style Bibliography: (Philip)

Ghuman, Prince. “How Psychological Biases Can Impact Investment Decisions.” Forbes. January 18, 2024. https://www.forbes.com/sites/princeghuman/2024/01/18/how-psychological-biases-can-impact-investment-decisions/.

Ingle, Dhiraj. “The Daily One: Psychological Mental Model of UX – Confirmation Bias.” Medium. September 12, 2023. https://medium.com/@dhiiraj4ux/the-daily-one-psychological-mental-model-of-ux-confirmation-bias-4fa752a276f7.

Leiden University. “How Many Dutch People Have Money Worries? The National Money Worries Monitor Hopes to Find Out.” Leiden University, February 28, 2023. https://www.universiteitleiden.nl/en/news/2023/02/how-many-dutch-people-have-money-worries-the-national-money-worries-monitor-hopes-to-find-out.

ClearTax. “What Is Investor Inertia and How to Beat It?” ClearTax. Accessed May 28, 2025. https://cleartax.in/s/what-is-investor-inertia-how-to-beat-it.